Would you eat a steak made from human sewage? Believe it or not, this concept has already been taste-tested and approved.

If you prefer your steak to be cooked rare, you may want to reconsider that choice after hearing about the latest advancement in food technology to come out of Japan: an edible steak made from human feces, reports Discovery News. (Update: Discovery News is now unsure if the story is real and wondering if they were duped. It reminds us of

this “Yes Men” poop burger hoax.)

Take a moment to let that gag reflex subside. Now consider this: it’s already been taste-tested, approved, and could eventually become a practical solution to sewage treatment. Someday “bowel burgers” may even provide an easy source of protein for the hungry.

The steaks were first envisioned by Japanese researcher Mitsuyuki Ikeda after he was approached by Tokyo Sewage to come up with a solution for the city’s overabundance of sewage mud. Although “eating it” probably wouldn’t have occurred to most people, Ikeda recognized that the mud was chock full with protein-rich bacteria.

After isolating those proteins in the lab, Ikeda’s team then combined them with a reaction enhancer and put them in an exploder. What eventually came out was no filet mignon, but it was edible.

“Theoretically, there’s nothing wrong with this,” said Douglas Powell, a professor of food safety at Kansas State University. “It could be quite safe to eat, but I’m sure there’s a yuck factor there.”

To make swallowing the stool steaks a little bit easier, a nutty flavor was added using soy protein, and red food coloring was mixed in too, apparently to make the concoction look more like a juicy, bloody steak. A few brave researchers even took the plunge and taste-tested the product. (Apparently it tastes like regular beef.)

The official composition of the lab-grown steak is 63 percent proteins, 25 percent carbohydrates, 3 percent lipids, and 9 percent minerals. (Which sounds a lot better than 100 percent poop). According to Powell, the idea isn’t really all that much different than eating plants that have been fertilized with manure or other excrement.

The idea could even help to solve the world food crisis. By comparison, researchers have also

proposed harvesting insect protein (i.e., “bug burgers”) as one possible way to help combat famine worldwide. Are “bowel burgers” really so much worse? They also take the ethic of recycling to its logical extreme.

Powell did offer one caveat to the future poo’d food revolution, though: because the steaks are made from human feces, there’s always a chance for contamination. If you’re brave enough to eat this, at least make certain that it’s properly cooked (as if you were going to eat one raw!).

When asked if he would ever consider eating one of the poop steaks if it wasn’t cooked, Powell responded matter-of-factly.

“I wouldn’t touch it,” he said.

IT GIVES THE EXPRESSION CRAP ON A BUN REAL MEANING

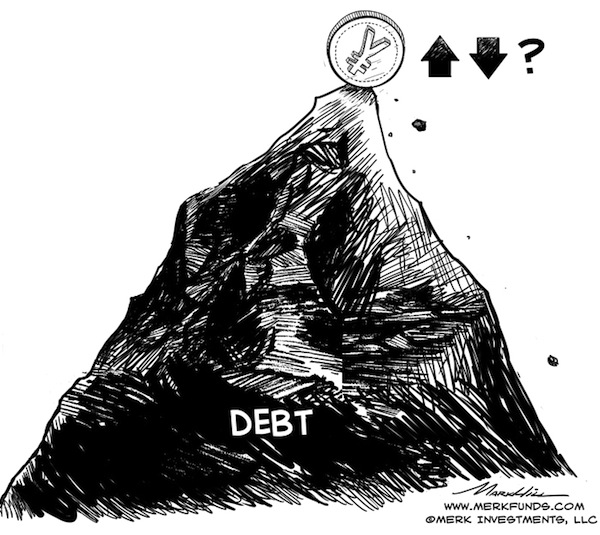

Is the Yen Doomed?

Is the Yen Doomed?